Accounting Made Quick With Quickbooks Online

As automation becomes increasingly pervasive, small and medium size firms are being introduced to the revolution of cloud computing by software like QuickBooks Online, helping them reduce time and money spent on financial accounting and management. The software is ideal for those who prefer working online, are looking for a low maintenance solution, run a service based business and need a product that can grow with them.

As their website explains, QuickBooks Online is essentially an upgrade of the desktop version by Intuit that now comes with powerful features and functions. While both help to systematically manage financial data, the online version adds flexibility to the software. Though available in different versions according to the varied firm requirements, the software is ideal for and most popular among small and medium sized businesses which often face a drawback in comparison to larger firms because of limited financial resources. Ways in which QuickBooks Online saves time:

- Client collaboration: Up to five users can sign into QuickBooks Online from the cloud. Client collaboration is possible as work done can be over viewed simultaneously at every stage ensuring higher standards of accuracy as well.

- Security: Software as a Service (SaaS) environments like this one, offer relatively higher security than small and medium sized businesses otherwise use. Data encryption services used are at par with those at premium financial institutions with the software’s servers protected by firewall, intrusion detection software and hardware and security systems, as iterated by sources such as the website, keepitsimpleaccounting.com. Apart from security, cost effectiveness is another feature of SaaS applications such as this one as the application is subscription based with free support. The product grows with the business and is easily scalable. Reclassifying transactions helps fix client category errors.

- Automatic upgrades and backups: The easy to use interface of the software facilitates quick access, enabling work to be completed with a bare number of clicks. Automatic backups and upgrades eliminate the need for manual work. Files are automatically backed up and there is no need to update software, allowing users to always use the latest version.

- Tracking employees and resources: Through the software, we can connect accounts online and also track work time of employees from remote locations. The degree of online tracking ranges to late arrivals, off days and number of hours clocked, eliminating the need to maintain a separate record. Likewise, resources like raw material can also be tracked easily.

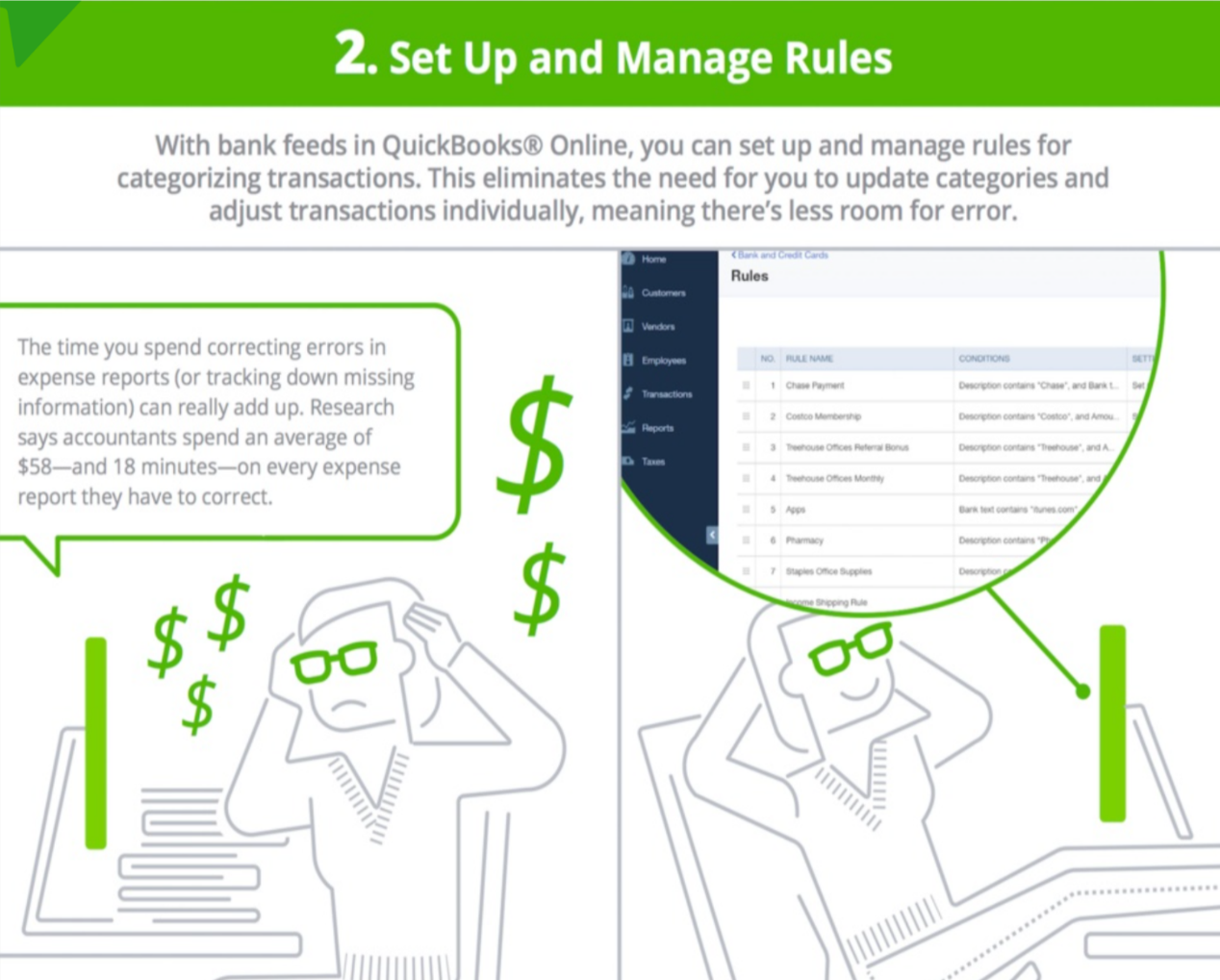

- Integration with third party apps: helps in updating accounts in real time. This ensures accuracy, speed and quality work. For instance, when clients connect bank accounts to the software, transactions are downloaded automatically enabling hand free data entry and less paperwork. Invoices can be customised with company’s logo and preferred font. The mobile phone version can work in sync with the phone to create emails, make calls etc.

- Speed and accuracy: Integration with third party apps and easy set up and implementation ensure speed and accuracy and more client time.

- Another problem the software solves is that it enables setting up automatic invoicing on recurring basis. The feature enables billing and payment collection for book keeping services. The accountexnetwork.com provides a step by step guide to set up a payment account. An active assistance centre ensures timely help when required.

- Affordability and Scalability: Cost of hosting is eliminated as data is securely stored on Intuit’s servers. Subscription based system and having your SaaS provider manage all your IT infrastructure helps create cost efficiencies. Upgrades and new features are free. Scaling up is possible without additional resources.

Access anytime and anywhere – Data and technology are both instantaneously available on the cloud. Users can access and work on data anytime and at any time by logging into their QuickBooks account. They can add and edit customers, clientele, vendor and employees, create lists for each of these categories, add and edit the list, create and email invoices, view bank account details, credit card balances, view balance sheet and P&L statements. Users can create custom reports and feeds. iPhones, iPads and Android can all be used for the software.

In current times, it is not just beneficial but essential for businesses to adopt technology driven software solutions such as QuickBooks Online. The software has enabled streamlining the management of financial data, which was until now undoubtedly one of the biggest challenges faced by small and medium firms.