Decoding Restaurant Accounting: For better cost control- Part 1 of 4

The restaurant industry is highly competitive. Unless you have a good eye on your financial metrics, chances are you will have trouble standing out from the crowd in the long run. Gaining a competitive edge requires a detailed analysis of the restaurant’s key performance indicators over the time.

Controlling costs in the restaurant business is critical. Typically a restaurant would have two types of major cost categories: One is the cost of goods sold i.e. everything from food cost, paper cost, cleaning cost to uniform cost and Second, Labor costs. By analyzing these costs, restaurateurs can detect potential problems, determine how to cut costs, and become more efficiently managed. Operating expenses and other performance measurements help restaurateurs see how their business is performing against those of similar profile.

Cost of goods sold and labor costs are considered to be the continuous financial obligations incurred in the daily operation of the business. Your recurring expense control can make a huge difference in your gross profit margin. It’s commonly thought that expense control happens out of necessity, not as an on-going business practice. In good times, when revenues and net incomes are increasing, expense control is viewed as unnecessary. There are two problems with this thinking:

- Expense control takes practice, and hence time. It does not happen in a day

- Expense control needs to be consistent, irrespective of good or bad times

In order to track operating expenses effectively, it is important that all expenses are properly allocated and analyzed.

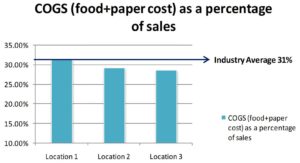

Here is a real life example of how we have analyzed and interpreted cost of goods sold and wages as a percentage of sales for three locations for 2nd Quarter of the 2018. Theoretically Cost of goods sold as a percentage of Sales refers to the amount of cost incurred against sales of every hundred dollars. So ideally lower the ratio better is the management of cost.

|

A recent study from Baker Tilly called Restaurant Benchmarking reveals that the industry average for COGS (including food and paper) tends to be around 31% for Quick service restaurant. Inour analysis it can be seen that, Location 2 (29.20%) & Location 3 (28.70%) performed better than Location 1 (31.40%). Food costs can be controlled by reducing wastage & pilferage. By keeping a track of these numbers and through regular reporting, you would be able to identify the areas of cost leakages and keep a tab on sales reports, thus having a watertight control over your business. |

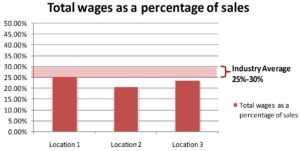

Another Important indicator is Total wages as a percentage of sales.

|

In the same study Baker Tilly states that Labor cost percentage of a quick service restaurant should not exceed 25% to 30% of its sales. As per our analysis, Location 2 has the lowest labor cost as a percentage to sales (20.60%) while other locations like Location 1 has 25.32% and Location 3 has 23.79%. But all three locations have their labor cost within the industry average range. Labor costs can be further controlled by reducing attrition, cross training employees so that same person can perform multiple jobs & investing in automation to reduce human interference. |

So the concluding thoughts are that, many restaurateurs in the food industry fail to calculate their costs correctly or to keep their costs updated. Once you have a good POS for determining food costs, inventory and wages, the software can keep your costs updated automatically. However, only software can’t analyze the fact whether your restaurant is performing up to the mark. You need to have a constant vigil on the data processed by your software in the back end and the task need to be vested to a reliable consulting firm.

We will be coming out with the subsequent parts of this series soon, where we will discuss some more parameters. We, at Fruxient Analytics, can help you keep your restaurant’s books up-to-date, show how our in-depth analysis can enable you to improve your performance matrices, and be your support system, so that you can take the reins of your restaurant’s finances. Click here to know more about our services for the restaurant industry.