Restaurant Accounting Case study – Gift Card Sales and Redemption

Once upon a time, giving gift cards wasn’t as respectable as buying an actual tangible gift, but today, they’re more popular than ever. They’re an easy way to buy gifts.

Gift cards are the prepaid card that contains a specific amount of money which can be used by the customer for future purchase of food. People who want to get a gift for someone but don’t quite know what to choose might consider a gift card. Similar to a gift certificate, it looks more like a debit card, with a magnetic strip on the back that logs the amount of money that the card holds. The recipient can use it like a debit card, spending up to the card’s value at the store designated on the gift card or, if no specific store is named, whenever he or she chooses. Virtually all major restaurant chains in the United states issue gift cards. Most gift cards have no expiration date, although a few are only good for a year from when they are issued. The money on the card also does not have to be spent at once. If the purchase is less than the amount of the card, a balance of credit remains which can be used in the future.

The accounting for sale of gift card is different from the accounting for food sales. Revenue is recognized only when it food or beverage items have been sold. The sale of gift card is an advance that the restaurant has accepted from its customers for which it has not yet provided the service/sold any goods, therefore ideally sale of a gift card is not recognized as revenue. It is in fact, recorded as a liability. But when a gift card is redeemed and the food is sold, revenue is recognised, and the liability is extinguished. Let’s look at the example below extracted from the POS of one of the leading Pizza chains in the US :

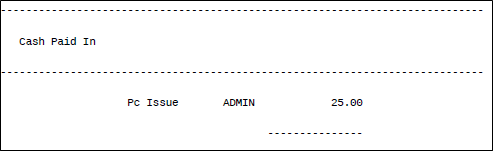

When gift card is issued:

When gift card is redeemed:

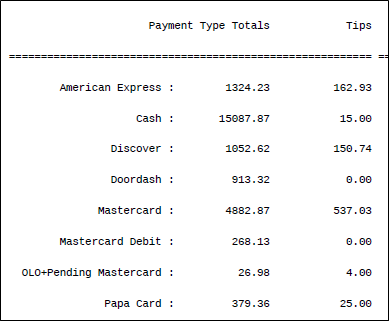

In this example, for a particular month the total Gift cards sold is $25.00 and the gift cards redeemed is $404.36.

We first must create a Gift card liability of $25.00 and then a Gift card asset of $404.36. Generally, gift cards payments are settled by the Franchisor on weekly basis. The difference of the gift card sales and redemption will be paid/deducted to/from our bank account by the franchisor. The accounting entry is as follows:

- Cash Dr________ $25.00

Gift card Liability Cr__________ $25.00

- Gift card Asset Dr________$404.36

Sales Cr________ $404.36

- Gift card Liability Dr________ $25.00

Cash at bank Dr__________ $379.36

Gift card Asset Dr________$404.36

$379.36 will be credited to our bank and will be matched from the bank feed in QBO, thereby completing the process. For more information on the tax aspect of Gift Card Accounting, we can refer to the following article.

https://www.firmofthefuture.com/content/gift-card-accounting-part-2-the-rules-for-tax/

Fruxient Restaurant Accounting

Today’s dynamic business environment is fraught with many challenges and uncertainties for restaurant owners, operators, and entrepreneurs. It especially gets tough to manage operations and associated challenges, and to meet all the deadlines, have updated accounts, work on growth plans, and the list is never ending. The challenge can be the lack of time or the lack of resources to hire additional full-time employees and the cost of associated infrastructure in your location. Don’t worry, the solution is right here.