Restaurant Accounting Case Study – Why we should enter DSR(Daily Sales Report) in a 2-part journal format?

-

Background – Our client is a franchise of Papa John’s Restaurant in USA and operates nearly 40 stores throughout the entire country. Before they started working with Fruxient accounting they were recording sales journal as per the below format.

-

Objective -The client informed that he was not satisfied with the current format and set us a challenging goal to locate the issue from an accounting perspective and set it right so that the reconciliations can be done easily.

-

The problem – From the existing format of the WSR(Weekly Sales Report), the following figures cannot be derived:

- Taxable sales in each period.

- Credit Card Receivables processed through various card issuers like Master, Visa, Diners and Amex.

- Break up of paid out and receipts.

- Tips payable.

- Gift card sales and redemption.

- Cash collected daily.

It is particularly important that these figures be recorded appropriately and reported and here’s why.

- Sales tax is a calculated as a percentage of taxable sales and not net sales. Therefore, verifying the percentages becomes difficult if we record net sales. Therefore, it is suggested to record Taxable Sales and Non-Taxable sales separately so that we can reconcile Sales Tax figures as well.

- The credit card receivables are settled separately for Amex, Visa, Mastercard & Discover. Visa, Mastercard and Discover is settled on a T + 2 basis and Amex is settled on T + 4 basis. If we enter the total daily credit card sales, the credit card receivables are less likely to match with actual bank settlements and we will have to prepare the credit card receivables reconciliation manually. To automate this, we suggest to enter the aggregate of the deposits based on the settlement cycle as different line items.

- The paid out and paid in comprises of different line items such as Mileage, daily wage pay-outs, cleaning supplies, maintenance, gift cards sold, gift cards redeemed etc. These line items should be allocated separately to appropriate expense/asset or liability ledgers. This would lead to more accurate reporting.

- Tips are not business income and it is paid to the employees either daily or along with the bi-weekly payroll. Tips accounting is important because:

- It helps to reconcile the money flow. i.e. the difference between cash collected and deposited in the bank.

- To ensure that the full amount of tips have been paid to the employees and the liability is paid off.

- If we record tips, then we can generate form 941 Quickbooks itself. This will help automate a part of the job and improve efficiency.

- In the current format of the WSR, Gift card sales and redemption are clubbed with Paid outs and Paid-in respectively. However, they are not actual paid outs and paid in. Gift card sales is a liability whereas gift card redemption are liabilities being paid off. The settlement of the funds of gift card sales and redemption happen on a weekly basis. It is suggested to record these separately because it will help us automate the gift card reconciliation.

- The above WSR only indicates the amount of cash that is deposited in the bank but not the amount of cash that has been collected at the store. Unless we know how much cash was received, we can’t prepare a cash trail and cannot identify cash theft if any. This problem can be solved by splitting the DSR Journal into two parts, One part will record the cash collected and the other part will record cash deposited in the bank which we have discussed in our solution.

-

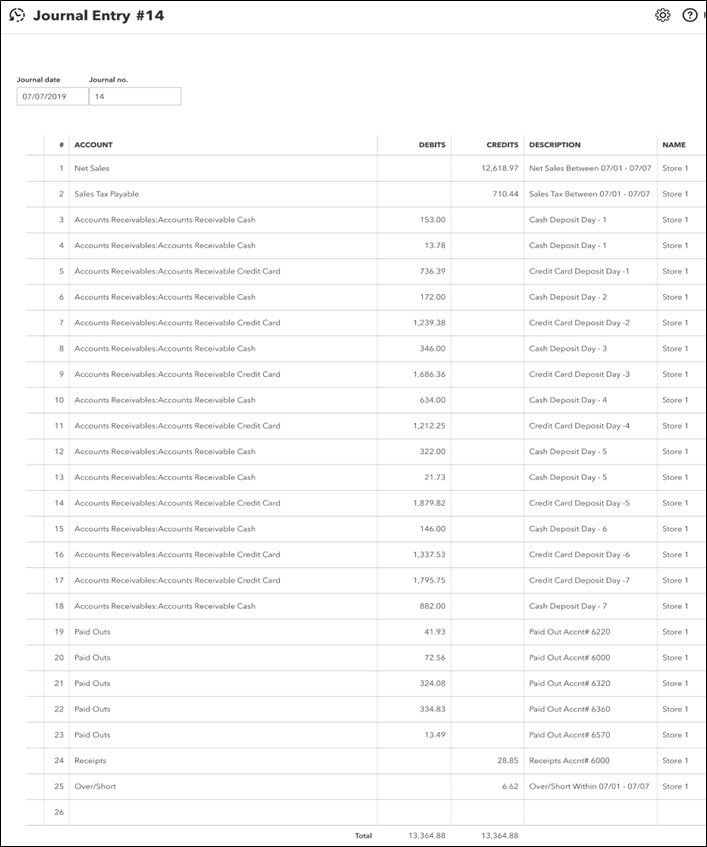

Solution Provided – Based on understanding of the problem, our expert team designed a two-part journal which would cover most if not all the issues described above.

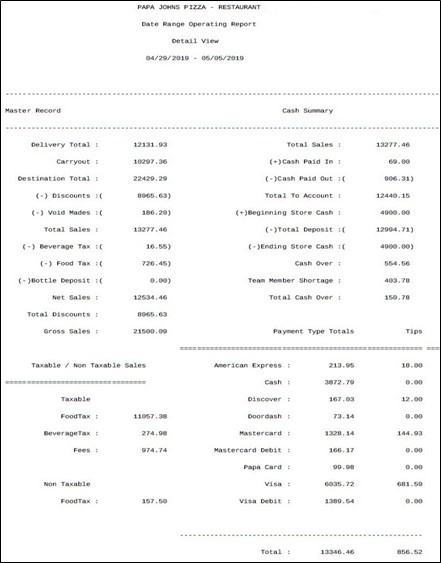

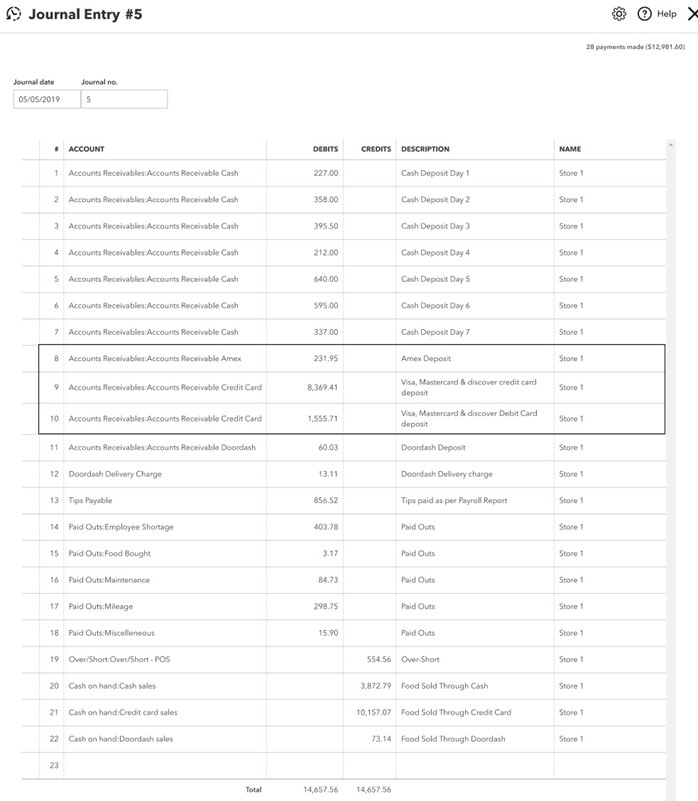

An example of store report is as follows:

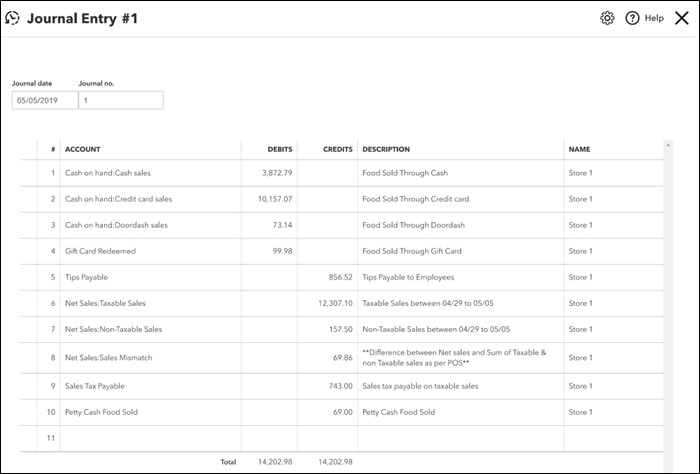

- First Part of the Journal –

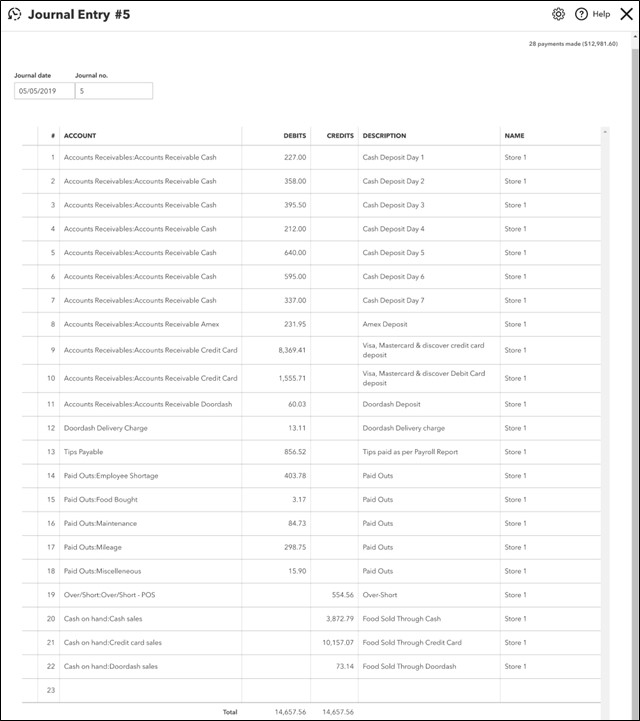

- Second part of the journal –

- Benefits of new method-

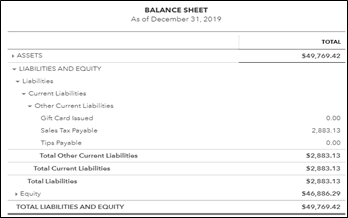

- Sales Tax Reconciliation is now automated. 6% of taxable sales i.e. $48,052.22 is $2,883.13 which is the sales tax payable. See the Screenshots below.

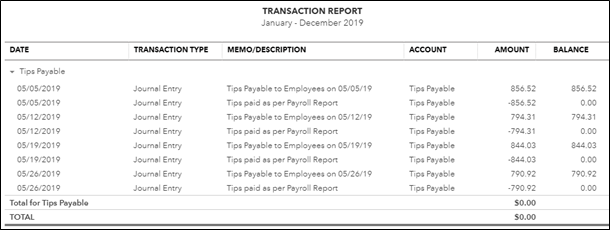

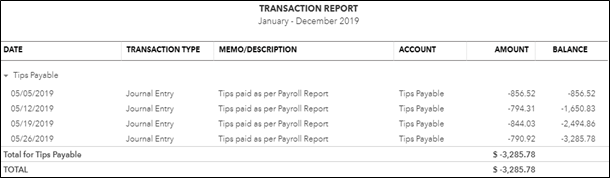

Tips Reconciliation is now automated within QBO. Illustration 1 shows that tips are being correctly paid off accurately. Illustration 2 shows the total amount of tips being paid to the employees in the given period.

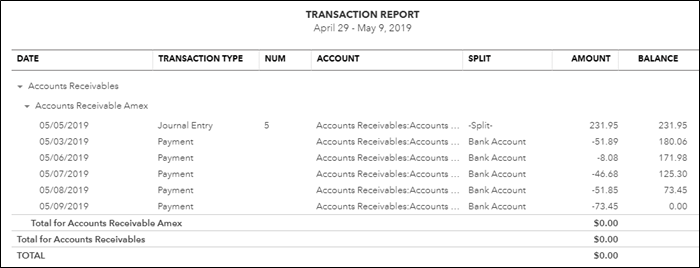

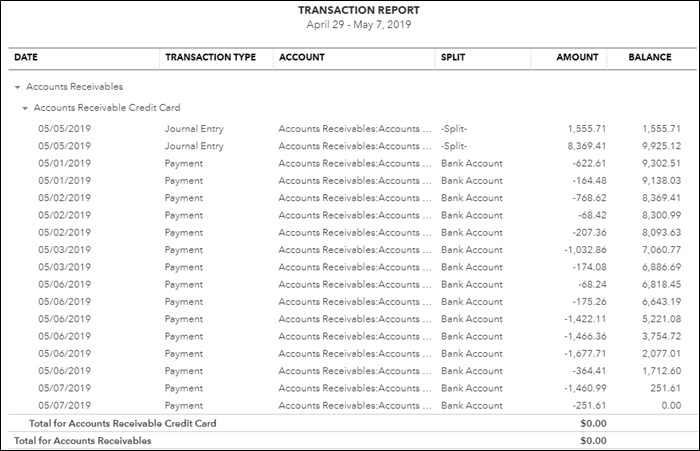

The credit card receivables reconciliation has been automated within QBO. Now that the credit card receivables are being entered separately according the settlement cycle and for debit cards, the bank deposits in the bank feed are being matched with the credit card receivables.

Here’s the Screenshot for matched payments. You will notice that the receivables zero out at the end of the settlement cycle. This indicates that the credit card processor has settled all the transactions correctly and the receivables are reconciled any theft or dispute. As a result, there is no need to run a separate reconciliation for credit card receivables.