Restaurant Accounting – How to significantly reduce Bookkeeping Costs

According to the Uniform System of accounts for restaurants issued by the National Restaurant Association, the budget for ongoing bookkeeping and accounting is about 1 percent of sales. For example, a restaurant with monthly sales of $60000 would expect to spend around $600 a month on their accounting activities. This would ideally include cost of subscribing various software for accounting like QBO, AP management like Bill.com and Hubdoc, Payroll processing software from ADP or Paychex or new-age restaurant management software like Xtrachef.

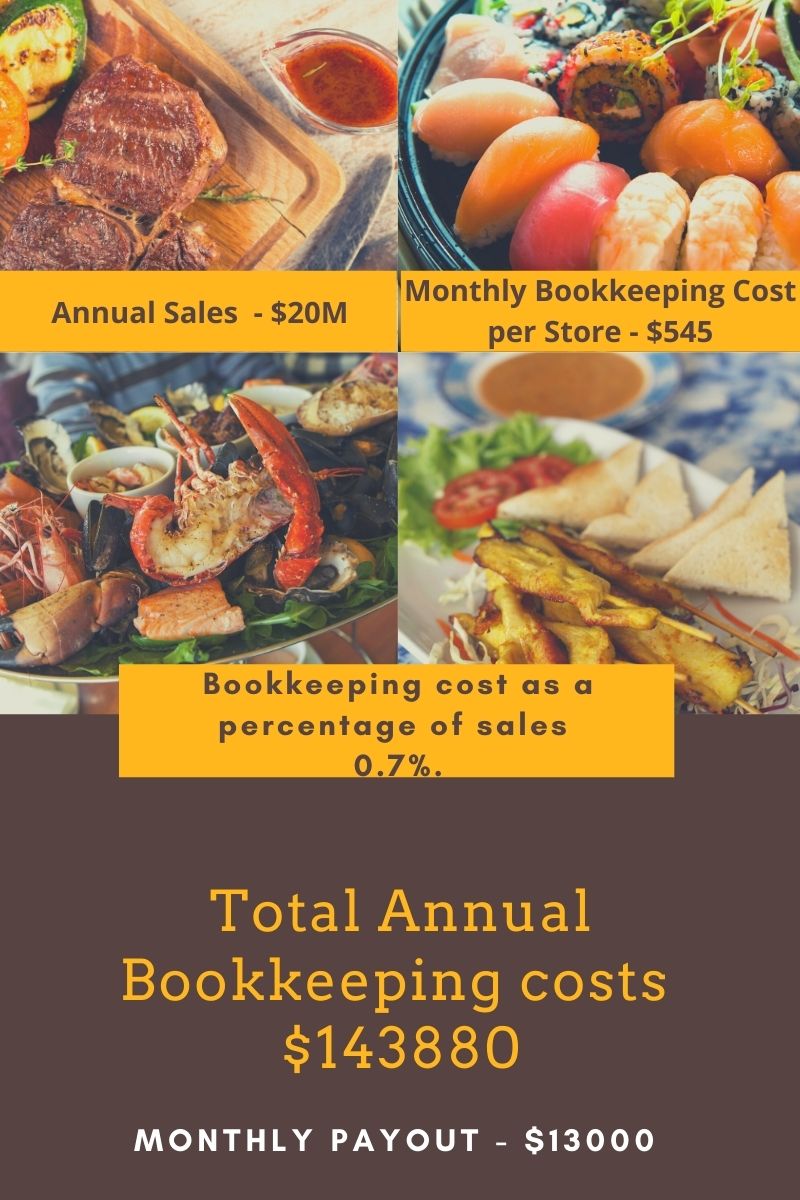

For a Multi-unit QSR Franchisee, the major chunk of this costs is Bookkeeping and Accounting costs. Software costs when calculated on a per store basis are minimal. Let’s take the example of a 22 store Franchisee of Five Guys.

In percentage terms it might sound an exceedingly small number but in absolute terms, the company was paying $13K per month for bookkeeping and accounting functions. That’s a huge sum of money. Critical point to note that the bookkeeping was already outsourced to a bookkeeping firm in the States.

Is there any way to cut down these costs? Yes, there is, read on.

- Outsourcing to a low-cost destination – A high-quality restaurant accounting outsourcing firm specializing in Multi-unit franchisee accounting would charge a maximum of $200 per store per month subject to a minimum. Considering the example above, that’s a guaranteed saving of $295 per store per month, or more than 50%. The minimum annual savings would be $85000.

- Combination of Outsourcing and In-house accounting – There can be compelling reason of choosing this option because it gives more control over the process yet helps bring the bookkeeping costs down. The bulk of the transaction work can be outsourced and the important work of consulting with vendors, administrative work, on-site communication can be managed by the in-house team member. In this case the minimum annual savings will be a of $40000. (Considering the pay for the in-house team member is $50000 for the in-house team member and the outsourcing firm will charge $40k)

Checklist – Key considerations of Hiring an Accounting outsourcing firm.

- Previous restaurant experience and other restaurant clients.

- Understands the importance of cash flow and receivables and can track, trace and report any missing monies.

- Capable of analyzing restaurant KPIs.

- Completes reporting within 15 days of the next month.

- Help you interpret your results through good reporting.

- A good restaurant outsourcing firm will have a staff that is experienced and knowledgeable in the intricacies of restaurant accounting and will be able to get the work completed more efficiently and accurately.

- Make sure that you completely understand the fees. Let there be no hidden charges or surprises.

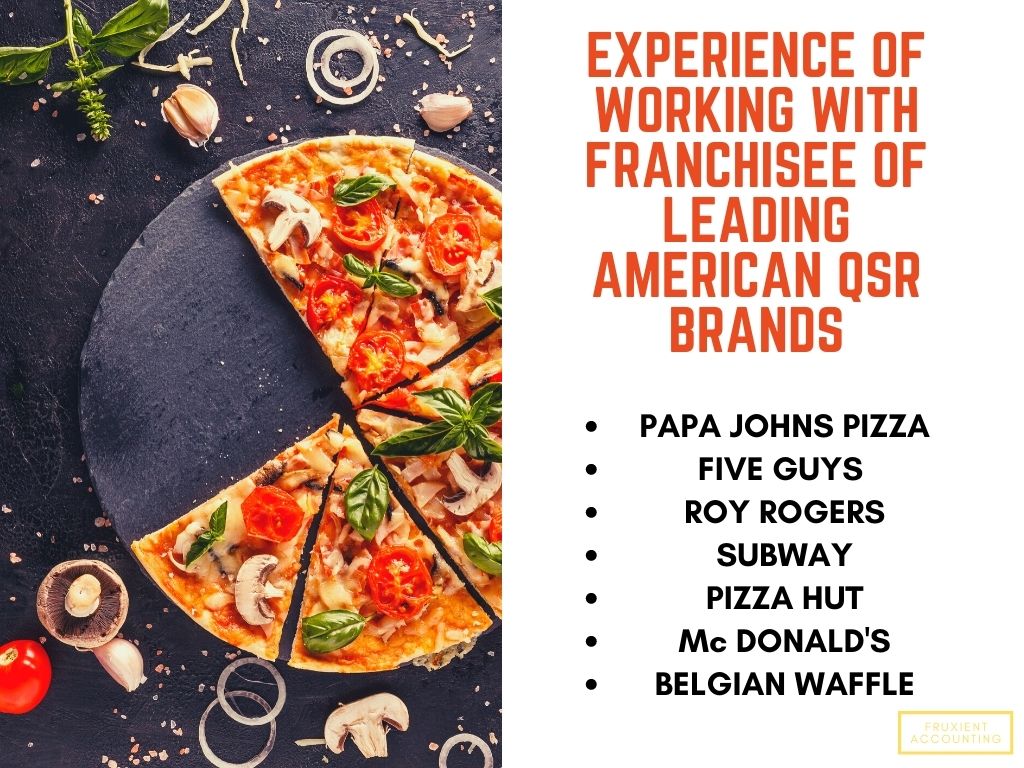

We at Fruxient Specialize in Restaurant Accounting for Multi Unit Operators of QSR and Fast Casual Formats. Fruxient Accounting We have been providing bookkeeping services since 2015. Our superior and integrated processes along with deep understanding of Restaurant accounting enables us to delight Restaurant owners by providing comprehensive accounting and strategic services.

Our Value Proposition:

- Superior Knowledge

- Accurate and Timely reporting

- Better cost control

- Minimize revenue leakage

- Maximize profits

- Help in process improvement

And all of this with 50% savings on bookkeeping costs.

By hiring us, you get a one-stop solution to all your accounting needs. We help you simplify your processes to streamline activities and improve efficiency.