Restaurant Accounting – Payroll Journal

A payroll journal entry is a method of recording expenses in the books of accounts of your restaurant pertaining to employee compensation.

A payroll journal entry includes employee wages, direct labour expenses, FICA expenses, payroll taxes, and holiday, vacation and sick days in the Debit section. Other items may be specialized payroll options, such as a 401k plan. The Credit section includes FICA taxes, state withholding taxes, federal withholding taxes, social security taxes, and Medicare taxes. Other items may be federal unemployment taxes and state unemployment taxes.

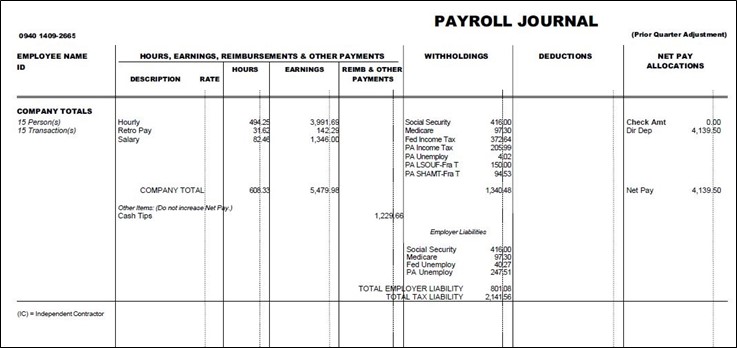

Let us look at the following payroll journal example:

This is an example of a bi-weekly payroll journal extracted from Paychex.

This is the Payroll Journal to be entered in QBO based on the above report:

| Particulars | Ledger type | Debit | Credit |

| Gross Salary | Direct expense | 5479.98 | |

| Employers Tax | Direct expense | 801.08 | |

| Employee withholding: Social Security | Current Liability | 416.00 | |

| Employee withholding: Medicare | Current Liability | 97.30 | |

| Employee withholding: Fed Income Tax | Current Liability | 372.64 | |

| Employee withholding: PA Income Tax | Current Liability | 205.99 | |

| Employee withholding: PA Unemployment tax | Current Liability | 4.02 | |

| Employee withholding: PA LSOUF-Fra T | Current Liability | 150.00 | |

| Employee withholding: PA SHAMT-Fra T | Current Liability | 94.53 | |

| Employers Tax Payable | Current Liability | 801.08 | |

| Net salary: Direct Deposit | Current Liability | 4139.50 | |

| Total | 6281.06 | 6281.06 |

Note, that we can classify the salary into different departments like managerial staffs, Kitchen staffs, Drivers etc. Department wise classification will help us analyse the departmental performance and plug the gaps.

Most of the payroll liabilities except few, in this case, PA LSOUF-Fra T and PA SHAMT- Fra T will be paid directly by Paychex to the respective government bodies.

| Particulars | Ledger type | Debit | Credit |

| Employee Withholding: Social Security | Current Liability | 416.00 | |

| Employee Withholding: Medicare | Current Liability | 97.30 | |

| Employee Withholding: Fed Income Tax | Current Liability | 372.64 | |

| Employee Withholding: PA Income Tax | Current Liability | 205.99 | |

| Employee Withholding: PA Unemployment tax | Current Liability | 4.02 | |

| Employers Tax Payable | Current Liability | 801.08 | |

| Net salary: Direct Deposit | Current Liability | 4139.50 | |

| Bank Account | Bank | 6036.53 | |

| Total | 6036.53 | 6036.53 |

PA LSOUF-Fra T and PA SHAMT- Fra T are the employee benefits, in this case, they are health insurance premiums and Paychex will not pay this amount to the concerned authority. The restaurant owner will have to be pay this directly to the insurance service provider. Refer to the screenshot of the Paychex report where it is clearly mentioned that Paychex will not remit these. In this instant case, the insurance service provider was United Healthcare and the client made the payment directly to the company. The transaction will be recorded as indicated below:

| Particulars | Ledger type | Debit | Credit |

| Employee Withholding: PA LSOUF-Fra T | Current Liability | 150.00 | |

| Employee Withholding: PA SHAMT-Fra T | Current Liability | 94.53 | |

| Bank Account | Bank | 244.53 | |

| Total | 244.53 | 244.53 |

Note – Cash tips do not affect the payroll journal. In this case, tips are paid out in CASH and not with the bi-weekly payroll. It is just recorded on the payroll journal as an additional information. This will later help us reconcile the tips payable account.